How Much Do Mortgage Brokers Make Annual, Should I Work, Get Paid 2021

Mortgage brokers earn an average of $92,262 per year in the United States, but this figure can vary based on factors such as experience level and geographic location. Mortgage Q&A: “How much do mortgage brokers make?”

If you happen to use a mortgage broker to obtain your mortgage, you may be wondering how they get paid and what they make. Mortgage brokers essentially work as middlemen between borrowers and banks/lenders, so they can actually be paid by either party. Just to be clear, this article is about how much mortgage brokers make on the home loans they originate, not how much they make in the way of salary.

Of course, brokers typically aren’t paid a salary, so if we know what they’re making per loan, we’ll have a decent idea as to what they might take home each year as well depending on annual volume.

How Much Do Mortgage Brokers Make Annual, Should I Work, Get Paid 2022

- Get Pre-Approved Today!

- Are you looking to purchase or refinance a home?

- I want to BUY a home

- I want to REFINANCE my home

- Are you looking to purchase or refinance a home?

Powered by Mortgage Research Center, LLC. By using this, you will be matched with participating members of the Mortgage Research Center, LLC network who may contact you with information related to home buying and financing. These members typically have paid to be included but are not endorsed by Mortgage Research Center, LLC or this site. Mortgage Research Center, LLC. is a mortgage licensee – NMLS ID 1907 Equal Housing Opportunity. Privacy Policy | Terms of Use | Licensing Information

But you have to consider their costs to operate as well, which will vary based on how large their shop is, if they employ loan officers, how much they spend on advertising (if any), and so on.

How Does a Mortgage Broker Get Paid?

- They can choose to get paid by either the lender or the borrower

- They can charge an origination fee directly, which comes out of the borrower’s pocket

- Or elect to get paid by the lender, which is indirectly paid by the borrower

- The latter results in a slightly higher interest rate, meaning it’s paid over time via higher monthly mortgage payments

In the recent past (before April 1, 2011), mortgage brokers could make money on both the front and back end of a mortgage loan.

Simply put, they could charge a loan origination fee directly to the borrower and also get paid by the mortgage lender via a yield spread premium (YSP), which was the commission the bank or lender provided in exchange for a mortgage rate above market.

In short, the higher the interest rate, the more YSP the broker would receive from the lender.

YSP was also referred to as “par-plus pricing”, “rate participation fee”, “service release fee”, and many other variations.

How Much Do Mortgage Brokers Make Annual, Should I Work, Get Paid 2022

Brokers had the ability to make several points on the back end of a loan, potentially earning thousands of dollars, sometimes without the borrower’s knowledge.

They could also collect money on the front end of a loan via out-of-pocket closing costs like loan origination fees and processing costs, which the borrower paid directly.

For example, back in the day it was possible for a broker to charge one (or more) mortgage points upfront for origination, receive another two points on the back from the lender, and also tack on things like loan processing fees.

All told, they could make three to five points on a mortgage, aka 3-5% of the loan amount. If we’re talking a $500,000 loan amount, that’s anywhere from $15,000 to $25,000 per loan!

And it could be even higher for jumbo loans. Prior to the housing crisis, it wasn’t unheard of for brokers to make massive commissions like this.

The Broker Life: How Much do Mortgage Brokers Make 2023

You’d hear about them asking for “max rebate” on the back end, which was the limit wholesale lenders would pay out, while still convincing the borrower to pony up an origination fee on the front end.

As a result, brokers could essentially be paid twice for the same transaction.

The beauty of it was the yield spread premium came in the form of a higher mortgage rate, so it didn’t even look like a fee or a cost to anyone – it just meant the borrower had a slightly higher mortgage payment for the entire loan term.

In other words, the borrower was saddled with a higher rate for the life of their loan and may have also paid a commission upfront, without realizing it.

Had the broker just charged the upfront fee and nothing else, the borrower may have received a mortgage rate of say 4% instead of 4.5%.

In hindsight, it probably didn’t matter because most of those loans didn’t last more than a few years (or months) before they were refinanced or foreclosed on. Eek.

How Mortgage Broker Compensation Works Today

- Brokers can no longer get paid twice on a single loan

- Instead they have to choose how they want to be compensated, by borrower or lender

- They may have a different compensation package with each lender

- So depending on where the loan is placed their commission could vary

As noted, the controversial practice outlined above was outlawed in 2011.

The Fed came in and changed all that by effectively banning yield spread premiums, and now mortgage brokers can only get paid by the borrower OR the lender, not both.

That doesn’t mean they can’t still make a lot of money per loan, it just means the way they can get paid via the wholesale mortgage channel has been limited.

In other words, they either charge you directly to close the loan or they get paid by the lender and you pay for that commission indirectly (not out-of-pocket at closing) via a higher interest rate.

If charging directly, the borrower pays for the broker fee or origination fee, loan processing, and so on. Compensation can also vary from loan to loan.

If being paid by the lender, it’s similar to YSP, but brokers must now choose a compensation plan upfront with each lender they work with, as opposed to charging different amounts on each loan as they see fit. And they usually must stick with that compensation plan for three months before they can change it again.

For example, they may choose to earn 1% commission on every loan they close with Bank A. So if the loan amount is $500,000, they’d earn $5,000. If it’s $300,000, they’d only get $3,000. And so on. But they may select a higher compensation structure with Bank B that gives them 1.5% on each closed loan.

Assuming the loan terms and cost are the same, they can send your loan to Bank B for a higher commission, as it won’t affect what you ultimately receive.

However, a different broker may decide to set all their compensation levels at 2%, and if you happen to work with them your interest rates may be higher across the board to account for their higher commission. So you kind of have to shop mortgage brokers too in order to find the one offering the lowest rate/costs.

In other words, you can still get a raw deal, or at least a not-as-good deal. The good news is they can no longer get paid on both the front and back end of the loan. But you should continue to be vigilant and look over your loan documents to ensure you aren’t being overcharged.

In short, you’ll want your broker to send your loan to the bank that offers you the lowest interest rate, not the one that gives them the highest commission.

Okay great, so what do brokers make?

- A survey said they were paid 2.25 points per loan on average

- On a $300,000 loan amount that would be $6,750 in compensation

- While it sounds like a tidy sum, you have to consider their volume and operating costs as well

- It’s pretty close to what real estate agents make, usually 2.5% of the sales price

A press release from 360 Mortgage Group detailing the compensation changes said mortgage brokers generate an average revenue of 2.25 mortgage points on a home loan. For example, on a $500,000 mortgage, they’d make roughly $11,250 in revenue. That sounds pretty good, doesn’t it?

But as mentioned, we have to subtract the costs of doing business, which are variable. From there, you’d have your profit per loan. Not a bad take for helping people get mortgage financing, depending on how many loans are closed each month, and what expenses are involved.

As you can see, mortgage broker salary will definitely vary based on the size of the loans they typically close. In more expensive areas of town (or the country), brokers might make six-figures or much, much more. While those in lower-priced metros could make significantly less if costs are still relatively similar.

How much does a mortgage broker make annually? 2022

Additionally, brokers who focus on mortgage refinances might have higher loan volume than those who help home buyers purchase real estate, as the latter can be harder to come by and slower to close. Of course, if they partner with a local real estate office or two, they have the ability to generate a ton of purchase loan business too, so it’s hard to say either specialty would be more successful universally.

Their average income will also depend on the financial institutions they choose to partner with, as compensation structures and points per loan will vary across different mortgage lenders.

One aspect of a mortgage broker’s job is linking up with lending partners that are good at quickly closing loans, while also offering competitive pricing. As such, these partners can greatly affect a mortgage brokers salary.

Will mortgage brokers still make the same money?

- While it might be more difficult to make a ton of money on a single loan

- Brokers still have the ability to make a very good living even with limited volume

- A broker who closes just $2 million a month could earn over $500,000 annually

- Very few other occupations pay anywhere close to that much

The 360 Mortgage Group believes brokers will be able to adapt to the compensation changes, and if you know anything about the mortgage business, new rules are typically circumvented overnight.

Many mortgage lenders are now publishing multiple mortgage rate sheets, with one version lender-paid compensation and the other borrower-paid compensation.

So brokers can simply pick up a specific compensation-based rate sheet they’d like and be on their way.

For example, if they want to make 2.50 points, there’s a rate sheet for that. If they only want one point, there’s a rate sheet for that too.

But the rule change will probably reduce average incomes for loan brokers, since they won’t be able to take a little from both the front and back of the loan.

Mortgage Brokers: What to Ask Before Using One 2022

Receiving compensation from just one entity, as opposed to two, means it’ll be more difficult to charge an excessive amount per loan, though not impossible.

This is relatively good news for home buyers and existing homeowners looking for refinance who will hopefully enjoy lower mortgage payments, but bad news for mortgage brokers, who continue to lose market share. It could also dent their total pay.

It’s recommended that you shop for a mortgage by gathering rate quotes online, at your local bank/credit union, and also via a mortgage broker or two.

You’ll never know who might have the best rate/terms unless you actually take the time to shop around!

Mortgage Q&A: “How much do mortgage brokers make?”

If you happen to use a mortgage broker to obtain your mortgage, you may be wondering how they get paid and what they make.

What does a mortgage broker do?

A mortgage broker finds lenders with loans, rates, and terms to fit your needs. They do a lot of the legwork during the mortgage application process, potentially saving you time.

How do mortgage brokers get paid?

Mortgage broker fees most often are paid by lenders, though they sometimes can be paid by borrowers. Competition and home prices will influence how much mortgage brokers get paid.

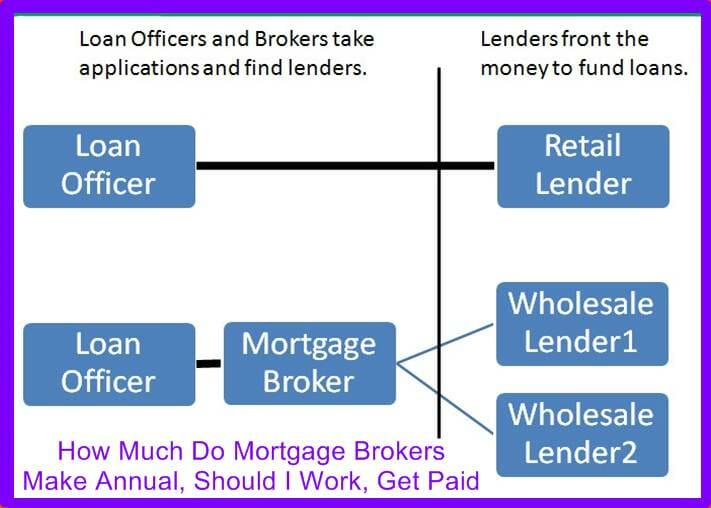

What’s the difference between a mortgage broker and a loan officer?

Mortgage brokers will work with many lenders to find the best loan for your situation. Loan officers work for one lender.

How do I find a mortgage broker?

The best way to find a mortgage broker is through referrals from family, friends, and your real estate agent. But don’t just take their word for it. Do your homework when selecting a mortgage broker by investigating their licenses, reading online reviews, and checking with the Better Business Bureau.

How Much Does a Mortgage Advisor Make Salaries – What Does He Do?

As a mortgage advisor, you will use your in-depth market knowledge to find the right mortgage products for your clients.

He will advise them on the pros and cons of each product and will also help them determine how much to borrow.

If you are a “whole market” mortgage advisor, you may also be an independent mortgage advisor or broker. Fit this classification, the regulations require you to offer advice on market-wide products (although this will not include products available directly from the lender) and give your clients options on paying for their services.

Content

Types of the mortgage advisor

Typically, you will specialize in one of the following ways:

- Linked to a single lender, usually working in a bank or mortgage loan company

- Looking at offers from a limited list of lenders

- Market advisor in its entirety.

Responsibilities

As a mortgage advisor, you will need to:

- Meet with your clients in person or by phone

- Explain what type of mortgage advisor you are and how they pay you

- Please find out about your client’s financial situation, including their monthly expense.

- Explain the different types of mortgages and offer products for your client to choose from

- Evaluate what type of mortgage is the most suitable for each client

- Make sure your clients can pay back what they are borrowing, not just now but in the future, in case interest rates rise or their circumstances change.

- Explain about repayments and mortgage protection

- Advise and sell related financial products, such as buildings or life insurance

- Help clients complete the mortgage application.

- Offer some general advice on the home buying process.

- Meet sales targets

- Dealing with mortgage lenders, real estate agents, and appraisers

- Keeping up to date with new mortgage products and changes in mortgage regulation

- Respect your client’s right to confidentiality

- Follow strict industry rules and guidelines and be sure to provide proper and appropriate financial advice.

- Understand the regulatory requirements of the Financial Conduct Authority (FCA) and ensure that you comply with them

- Cooperate fully with any inquiries or investigations by the financial ombudsman if things go wrong and a client exercises their right to protection.

Salary

- Basic starting salaries for mortgage consultants typically range from $ 22,000 to $ 25,000. A commission can pay in addition to this.

- With a few years of experience, you can expect to earn in the region between $ 45,000 and $ 60,000, including commission.

- Highly experienced advisers can earn up to $ 70,000, including commission.

Income figures are only a guide.

Working hours

Typically, you will work 35 to 40 hours a week. You could work standard office hours, but it is common for the job to involve work at night and on weekends, as you have to stick to clients’ schedules.

What to expect

- You can be in the office or work from home.

- Frequent local travel may be required for visiting clients, especially for initial consultations, although much of the later work can do via email, phone, or text message.

- The job is available in all areas of the UK, although with potential for many clients in towns and cities.

- The mortgage advisor role is suitable as a second option or career change and for young people entering the first career.

- An equal number of men and women work as mortgage advisers.

Ratings

To become a mortgage advisor, you must complete the Certificate in Mortgage Counseling and Practice (CeMAP) course. This Level 3 course is FCA approved and is sought by employers as the industry standard.

CeMAP can be studied independently or with the support of your employer. Many course providers offer flexible study arrangements, including distance learning. The course, made up of assessment modules and exams, can generally be completed in a period of between six months and two years.

The Chartered Insurance Institute (CII) offers the equivalent Certificate in Mortgage Advice qualification, also approved by the FCA.

A degree is not essential to a career as a mortgage consultant, but the following may be helpful:

- Accounting and Finance

- Business and management skills

- Real estate.

Entry with an HND is possible. You do not need a graduate degree. A variety of more general finance graduate courses are available, and some advanced mortgage counseling courses, including the Certificate in Advanced Mortgage Counseling. It will help to have good GCSE scores, including maths and English.

You can enter this career through a banking or construction society training program or an apprenticeship. For information and details of learning providers, see GOV.UK Apprenticeships and the Learning Institute.

Most employers expect you to have a credit check and a criminal background check, which they will coordinate for you.

Abilities

You will need to have:

- Excellent communication and listening skills

- The ability to explain complex information clearly

- The confidence to work with numbers and explain financial figures and products to your clients

- Excellent customer service skills

- Drive and motivation to meet goals

- Good IT skills

- Good time management skills and the ability to juggle a busy workload.

- Punctuality

- Discretion

- An honest and trustworthy approach

- An interest in the financial sector

- Good math skills.

Work experience

Gaining relevant work experience in finance, customer service, or sales will increase your understanding of the financial industry and help make your job applications more competitive.

It is possible to move up from a customer service position at a financial institution or as a mortgage servicer at a brokerage firm. Some banks and housing credit societies run training programs.

Employers

A self-employment is a common option for mortgage counselors, but you can also find employment with:

- Banks and construction companies

- Real estate agents

- Mortgage broker firms.

Look for vacancies in:

- Workplace

- Totaljobs

You can also check the websites of banks and mortgage companies.

Specialized recruitment agencies include:

- Pure resources

- JDC

Professional development

You can choose to become a freelance and independent mortgage advisor, managing your number of clients. It will involve an element of sales and marketing work as you will need to find new business and perform the actual work of a mortgage consultant.

With experience in an employee position, you could progress to managing a team of mortgage advisers in a senior/managerial position.

Membership in a professional body such as the IIC provides access to technical and market knowledge and various training and networking opportunities. It also enhances your professional potential by providing practical support for your Continuing Professional Development (CPD).

Career prospects

It is possible to gain further qualifications to become an Independent Financial Advisor (IFA), advising on a broader range of financial products.

You might consider establishing your mortgage broker firm, where you would have overall responsibility for a team of independent advisers and handle the associated business administration, promotion, and marketing activities involved in running the firm.

Other prospects include becoming a financial controller or wealth manager and advising on investments for clients with a certain value or higher portfolio.

Advances in digital technology are likely to spawn some changes in the mortgage industry. In particular, in artificial intelligence, as Robo-advisers move even further to integrate with human advice.

Related searches

how much do mortgage brokers make in Canada

how do you become a mortgage broker

mortgage broker salary

how do mortgage brokers make money

how much do mortgage brokers make Reddit

mortgage broker salary 2019

mortgage broker commission

how much do mortgage brokers make in California

AmeriHome Mortgage Company LLC Profile, News Reviews 2021

Sebonic Financial Mortgage Loan Companies Ratings & Reviews 2021

Embrace Home Loans Mortgage Reviews Inc, Complaints, Better Business